A picture is worth a thousand words, so for this insight I have selected for you the best graphs that I saw over the last couple of months:

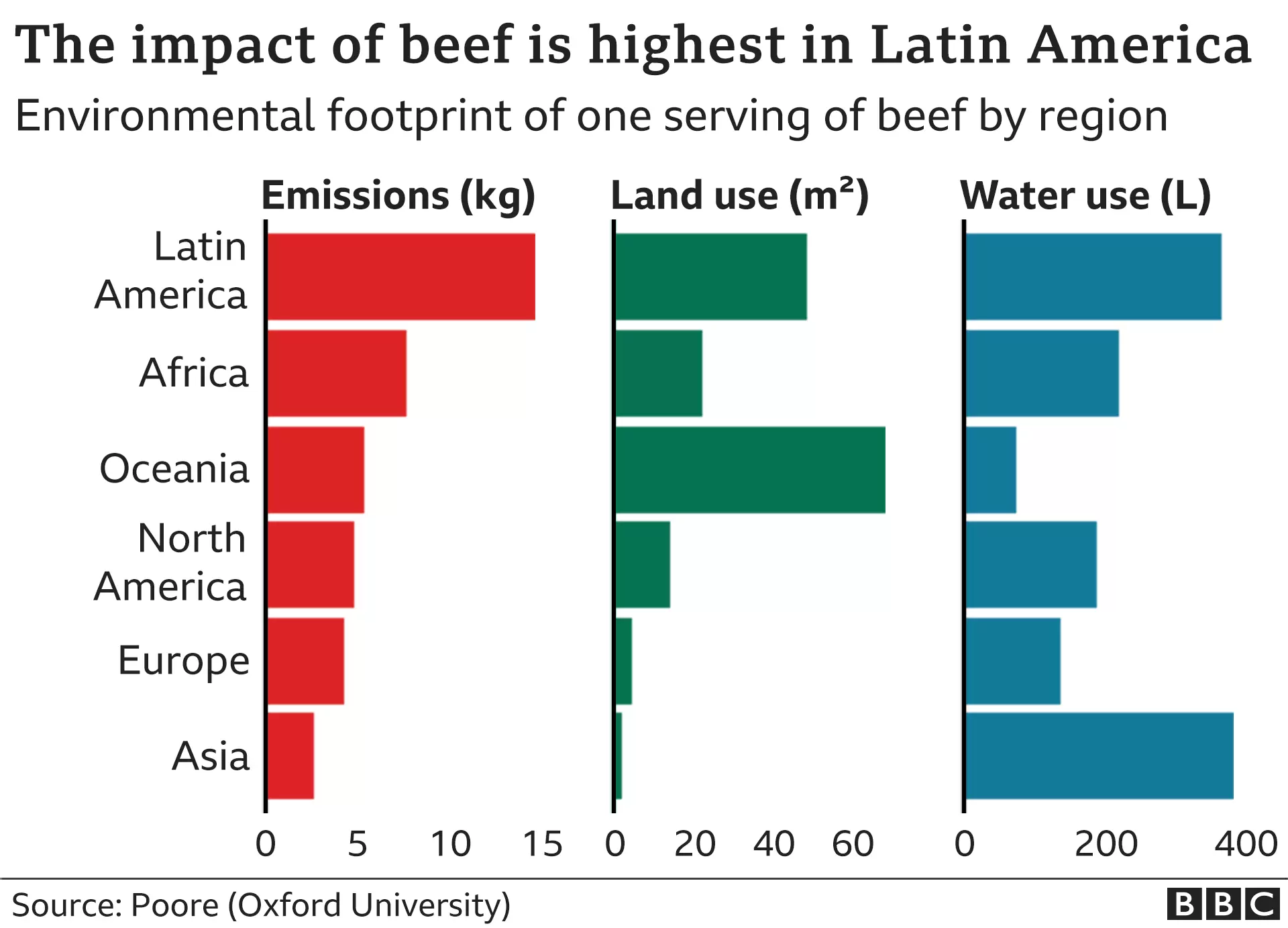

All beef are not equally environmentally harmful

It is often said that in our current Western diet, meat and dairy have the highest impact on the environment. This is generally true, but actually, as often, the reality is a bit more nuanced. The choice made by the consumers has a real impact. As shown below, just for a single beef serving, the environmental footprint can vary widely, notably for emissions between regions. It’s not even useful to consider transport which is not relevant when we talk about high-emitting elements such as animal proteins.

Regulation, culture and the availability of resources can make widely different outputs. Just accounting for emissions, beef from South America is four or five times worse than beef from Europe. And inside regions, things can also vary widely. For example, UK-grow beef is much less emitting than French beef.

This argument is often used by some “anti-plant-based” observers, such as here, saying that going grass-fed and using the best practices worldwide would be sufficient to transform our food system into a sustainable one. I am quite dubious about that (as I am equally dubious about the idea that in the near future, there will be no more cows on earth).

If you want to know more about the future of proteins, notably opportunities and challenges, we have worked on an insight report on this subject with MSCI, a leading financial company editing a food revolution index. You can download it (for free) here!

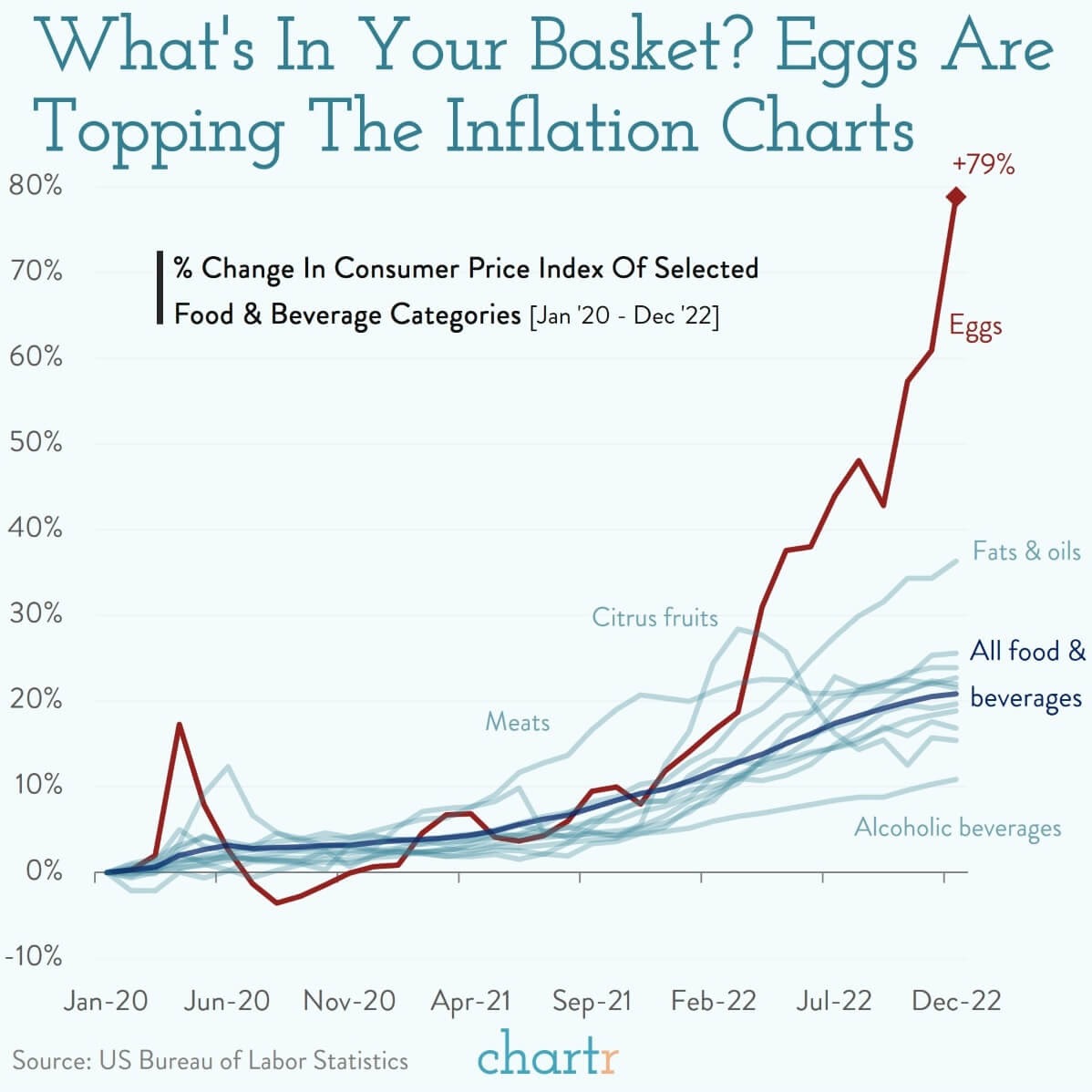

Increase in price ⇒ increase in deals?

Do you want to understand all the deals being made around egg replacement, fats and oils alternatives in the last couple of month ? Just have a look at the graph below. I always find it funny when a temporary external event (in the case of eggs, the reason is due to a rise in the number of case of avian flu in the US) creates waves of investment. It is often short lived. But who knows.

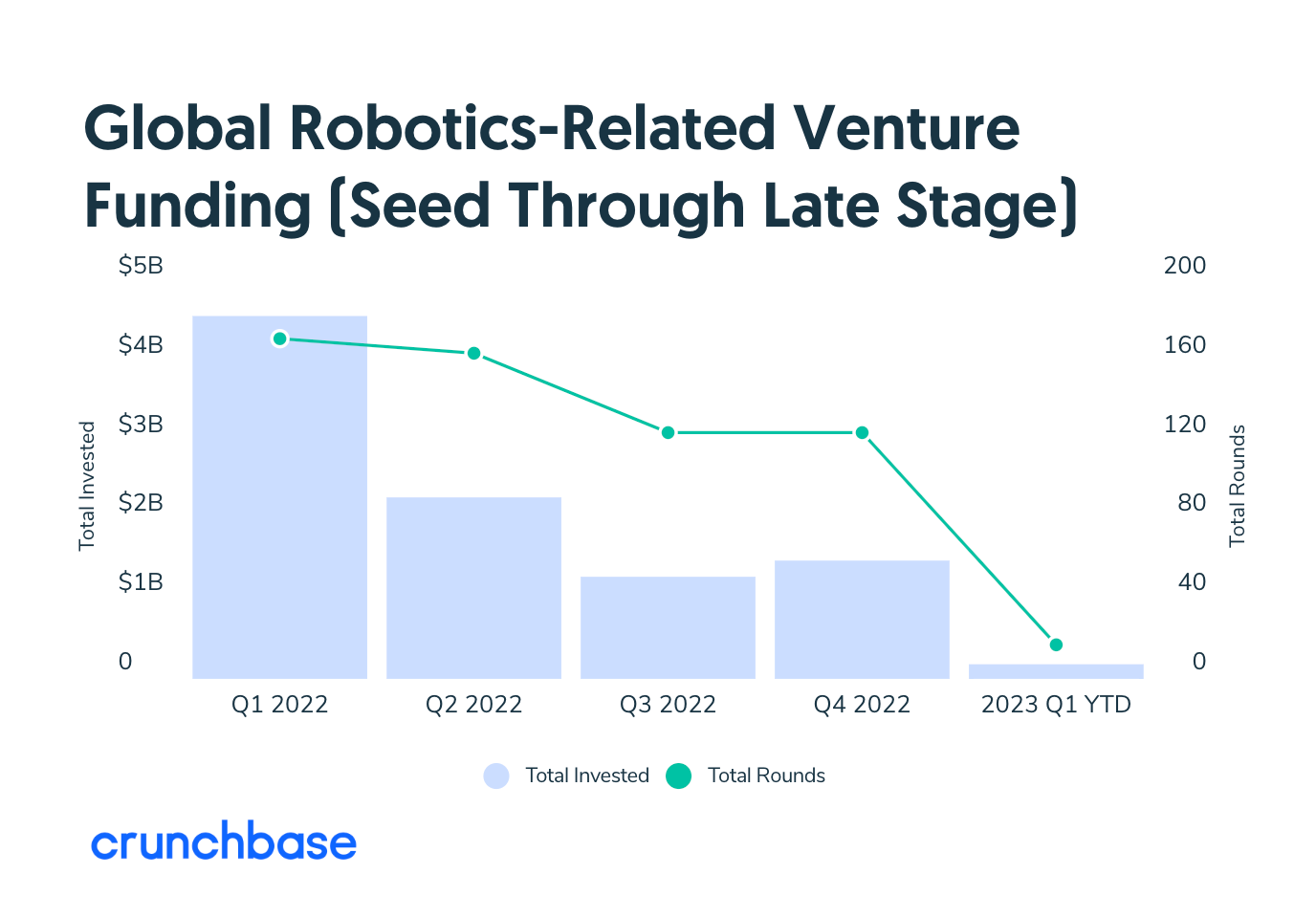

Robot startups are having a hard time

We have mentioned here the rising number of cooking robot startups having a hard time and shutting down their operations. It seems that it is not only in food that robots are facing hardship. In the graph below, we can see that the number of deals and the amounts have plummeted in the past months. On a more positive note, it should be noted that many startups in farm robotics are still raising money. And, as explained in our insight note on the subject, many interesting food robot startups are being developed.

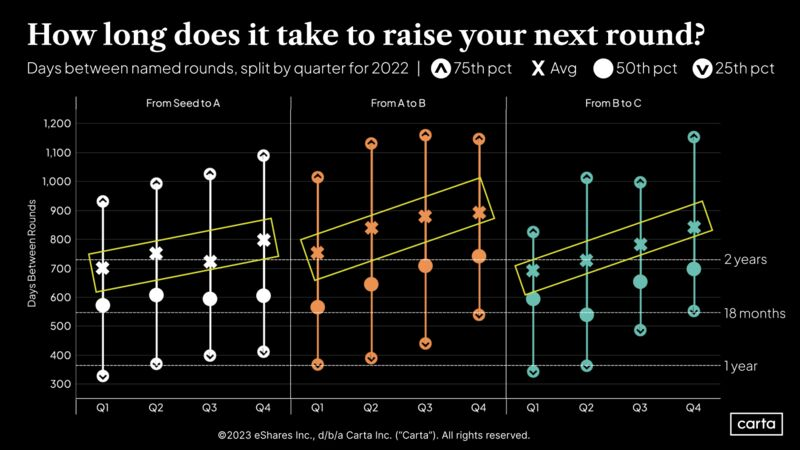

If you are a startup planning to raise money, I hope you have some cash reserves

All along the investment funnel (from seed to late stages of funding), the time between two rounds is getting longer. In less than a year, the time between seed and series A has grown by 100 days. 3 months is a lot for a startup that is planning to raise money between 18 to 24 months after its last round.

The graph also shows that this trend is strongest for series B. There, it now takes on average one additional year for a startup to raise capital. That’s a huge difference and that’s also why, we expect to see a lot of failures in the months to come: startups that raised series A in 2021 when investments where booming are “due” to raise this year… and may have a really hard time in front of them.

Have you seen other graphs that you find interesting about the future of food? Share them with us for our next newsletter.

8