📦 🇳🇱 Pieter Pot, a Dutch startup providing packaging-free groceries using reusable pots, is being acquired by its washing partner Delicatessenfabriek. It is not a happy ending though. The startup is on the verge of bankruptcy and was never able to get profitable. Pieter Pot was a small player, it was seen as one of the most interesting. This shows how difficult it can be to impact the food supply chain.

☕ 🇫🇷 Sensaterra, a French B2B coffee marketplace, raised €1M. The startup is focused on artisanal products for traceability, composition and quality. This notably helps its clients to meet their CSR challenges.

🧀 🇺🇸 What a shame! US-made cheese can now be named “gruyère” according to a new court rule. It is considered a food common name and not a product specifically produced in France and Switzerland.

You may wonder how naming a cheese with (or without) holes is linked to the future of food. Actually, the question of how to name alternative proteins is a source of great debate. Italy just banned the use of “meaty” names for plant-based alternatives, and precision fermentation companies are wondering how to name their products (”animal-free dairy”, which is still in use, maybe not so appealing). It is fascinating to see that “old food” and “new food” are trying to create barriers through naming.

🔴 🇩🇰 Chromologics, a Danish startup raised an additional €7.1M for its red food colourant. Doehler, a global food supplier, notably led the investment.

🇮🇱 🌶️ Saffron Tech, an Israeli startup, raised $1M for its saffron produced through vertical farming. Saffron’s yields are suffering due to climate change, and indoor farming could be an answer to have a more reliable production in the future.

🍼 🇩🇪 YFood, Germany’s meal replacement startup, received an undisclosed investment from Nestlé. In 2022, YFood reached a whooping €120M in sales, making it one of the most successful food D2C brands in Europe (alongside Huel, its British meal replacement competitor)

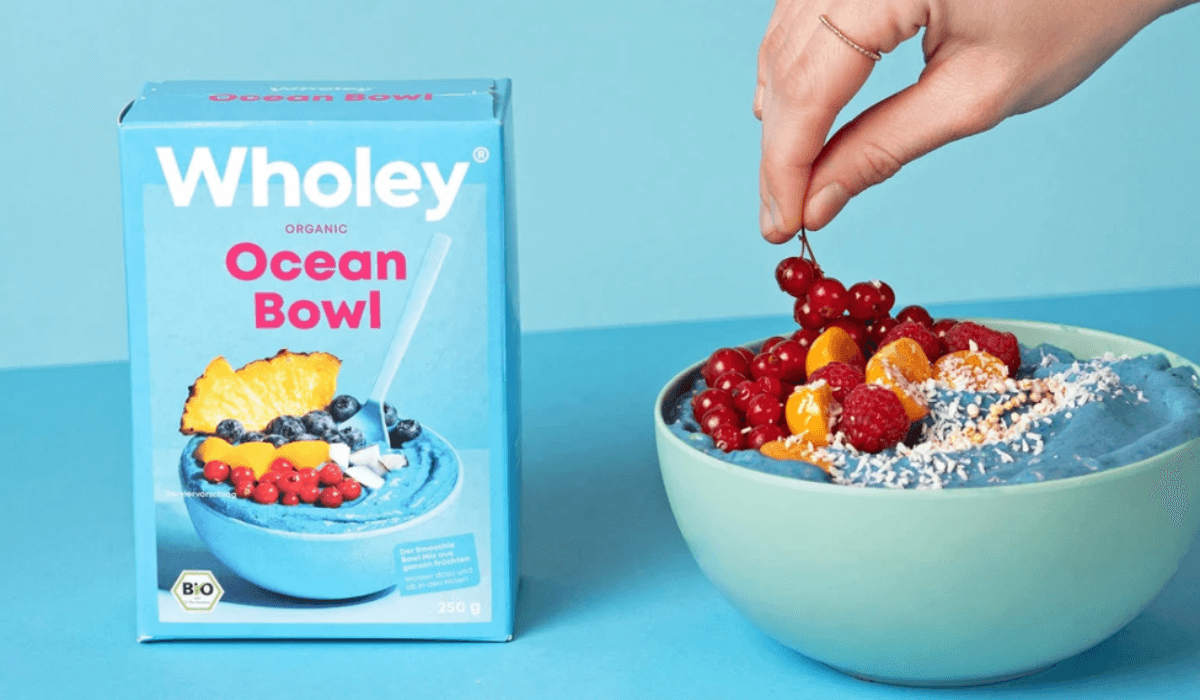

🥣 🇩🇪 Wholey, a German vegan breakfast D2C brand, raised €6.2 million to expand its presence in retail across Europe. It is surfing on the trend of healthy and tasty breakfast products (already big in the US, but almost absent in continental Europe beyond granola).

🥩 🇬🇧 This, the UK-based plant-based meat startup, raised £15M from traditional investors and from a crowdfunding campaign. It will notably use this money to expand in new countries. If you are unfamiliar with the brand, you should look at its very British and quirky communication style. I wonder how it will be received in other areas.

🇺🇸 🍪 Patagonia Provisions, the food brand of the well known outdoor clothing company, acquired Moonshot, a snack startup focused on regenerative agriculture practices and short supply chains.