FoodTech unicorns: Growing stronger and faster

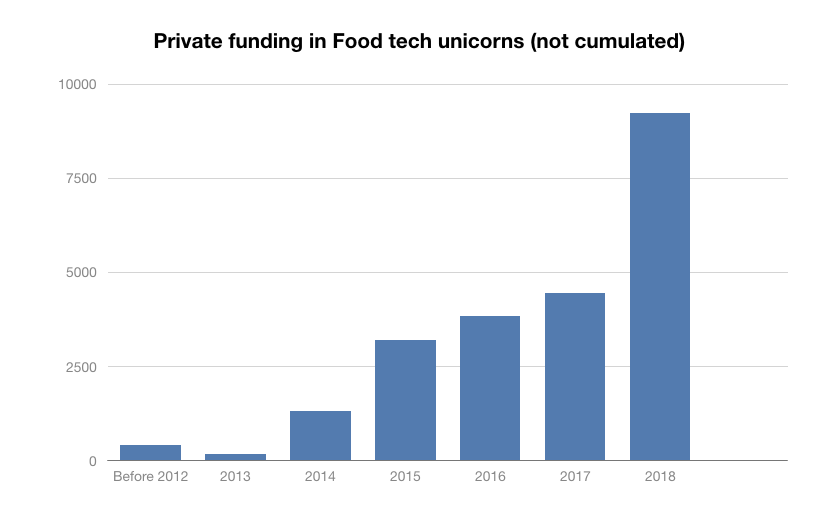

This report is based on the study of the 33 FoodTech unicorns founded worldwide since 1998. Combined, they raised $26.6B in private funding since 1998. With more than half the total amount ($16.2B to be precise), the last two years have seen a huge increase. It’s our first conclusion, investors have gone more and more generous with FoodTech leaders.

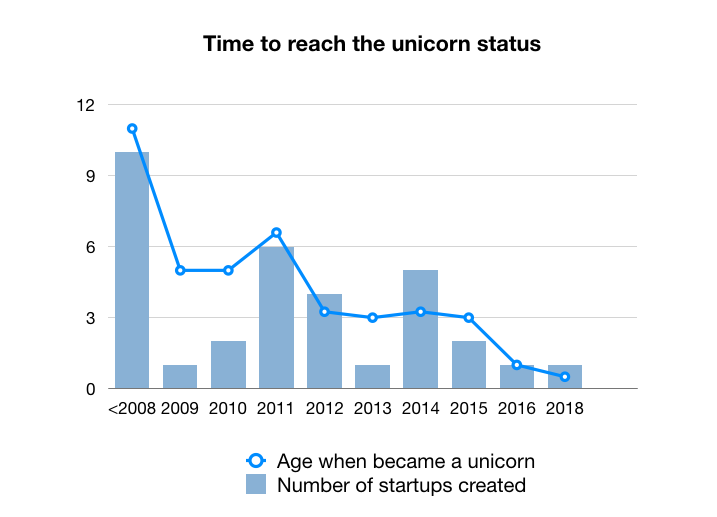

Our second conclusion concerns the pace at which the startups have risen to the unicorn status. When created after 2012 a unicorn is 3 times faster to reach the $1B valuation milestone.

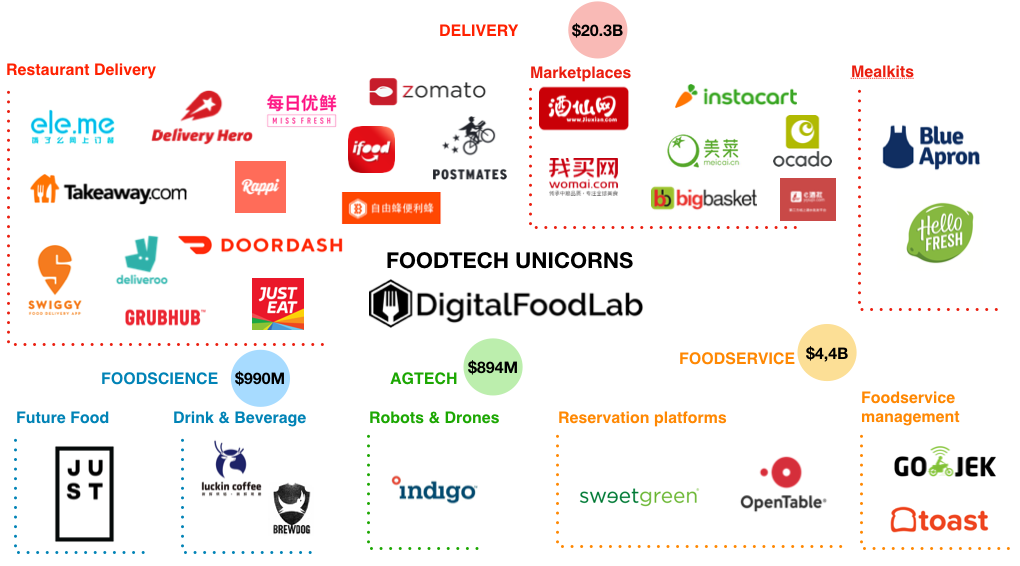

And finally, the number of unicorns has increased significantly since 2000, from 23 in 2012 to 33 in 2019.

Psst, by the way, what is a unicorn?

A unicorn is a startup with a valuation (the worth of the whole company) bigger than a billion dollars. It can be private or public but must have reached this valuation before going public.

Where does the word « unicorn » come from?

The term unicorn was invented by a woman, Aileen Lee. This American venture capital specialist conducted a study in 2013, showing that less than 0.1% of the companies in which venture capital funds invested had valuations in excess of USD 1 billion. The word unicorn refers to something rare, utopian.

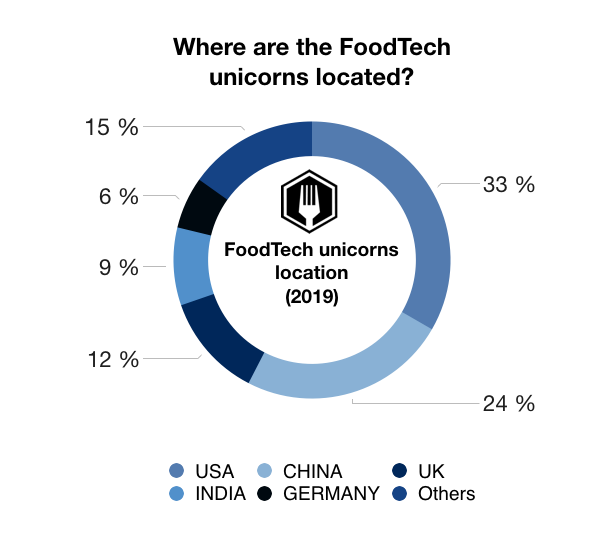

Where are the food tech unicorns located?

The majority of the food tech unicorns are located in the United States: 11 unicorns of the 33 are Americans. They are present in Delivery (e.g. DoorDash), Agtech (e.g. Indigo), Robotics (with Zume Pizza) and FoodScience (e.g. Just).

The leading position of the United States over the rest of the world can be explained both by a long tradition to grow strong startups and higher valuation (themselves linked to bigger deals and more cash to invest in the startups). China is behind and the UK in the third place.

Between 2000 and 2019, the order of countries in terms of unicorn creation did not really change.

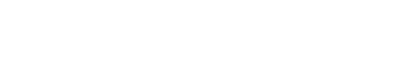

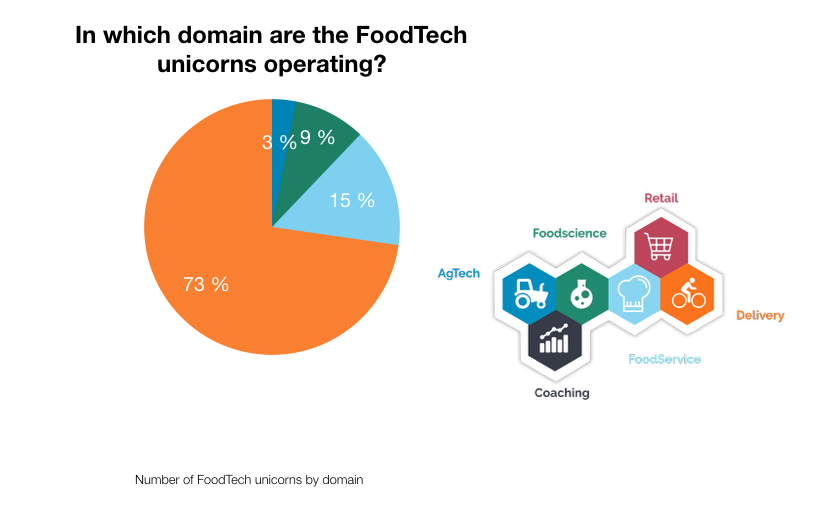

In which domain are the FoodTech unicorns operating?

The Delivery domain is the most important. It represents 73% of food tech unicorns in number and 77% of the investments. There are 24 Delivery unicorns in the 33 unicorns.

The Restaurant delivery subdomain (with key players such as Deliveroo) contains one-third of the unicorns. It is a growing market as more and more people either don’t have the time, the skills nor the will to cook. Europe is the first provider of such startups.

In the second place, we can find the marketplaces unicorns which are mostly Chinese. Indeed the country is building its network of restaurants and grocery stores and both consumers and businesses are easier to convert to more innovative food product sourcing (even more if it brings more transparency).

Is there an evolution between 2000 and 2019?

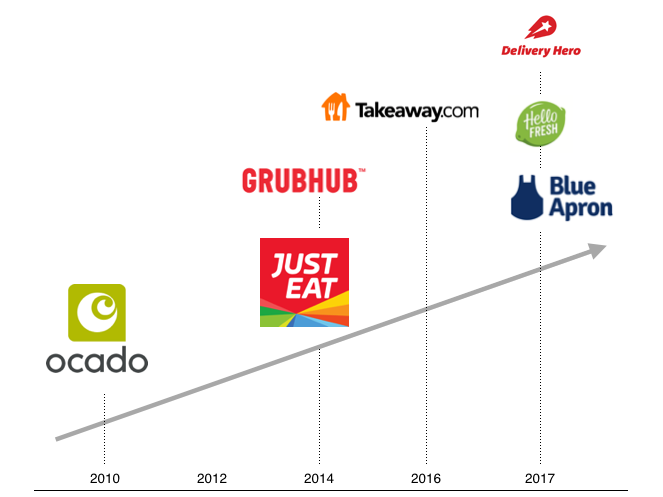

The restaurant delivery and marketplace sectors are constant over time. The meal kits startups (such as HelloFresh or Blue Apron, now public companies) appeared mainly between 2012 and 2014. Robotics seems to be the next trend for unicorns with 3 new startups valued more than $1B in this field.

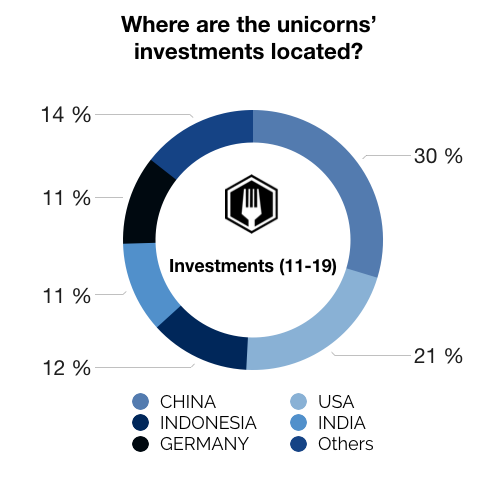

What is the distribution of the unicorns’ investments?

30% of the money is raised by Chinese unicorns and 21% by American unicorns. This can be explained by the fact that there are bigger investors with more cash to invest.

The distribution of the unicorn’s investments between the sectors is almost the same than the distribution of the foodtech unicorns, and it is logical. More unicorns there are in a sector, more there are money raised.

- Delivery : $20.3B

- FoodService : $4.3B

- FoodScience : $991M

- AgTech : $894M

How much should a startup raise to become a unicorn?

While some raised only $48 million like OpenTable or $117M like Just Eat, others raised more than $3.3B like Ele.me (bought by Alibaba in 2018) or $2.6B like Delivery Hero. There is not one rule to follow; it depends on the country, the maturity of the market, the customers and the concept of the startup.

- In the “Food delivery” sector, the majority of startups have raised more than $100M 3 or 4 years after their creation date.

- In the “Marketplaces” sector, some have decided to raise amounts of less than $100M every year like BigBasket or Jiuxian, and others to raise amounts of more than $100M every 2-3 years like Instacart or Meicai.

- In the “Meal Kits” sector, the amount raised is lower, Hello Fresh raised $364.5M and Blue Apron $173.6M.

In general, the cash invested in the FoodTech unicorns has increased since 2000. Investments have gone from $176M to $10.9B in 2018.

How many unicorns were acquired?

Two unicorns were acquired, Open Table in the foodservice category and Ele.me in the delivery sector.

These acquisitions are proof of their success and have enabled them to grow through new investments.

How many unicorns are on the stock exchange?

7: The latest are Delivery Hero, Hello Fresh and Blue Apron in 2017.

A startup decides to go public when it wants to grow but is reaching the limit of its debt capacity. Initial public offerings are mainly used to raise funds and get a great image.

Becoming a unicorn is faster than ever

The number of unicorns has increased a lot since 2000.

However, in the 19 startups created before 2012, 42% took more than ten years to become a unicorn. And in the 14 startups created after 2012, 86% took only 3 years to become a unicorn.

So, as it can be seen in the graph (which should evolve when startups from previous years will become unicorns), it takes less and less time to become a unicorn.

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de l’Opéra, 75001 Paris, France