INSIGHT:

Looking at the top deals of an ecosystem is much more interesting than what we may think. Indeed, as the ecosystem matures, investments tend to concentrate on a smaller number of startups and then looking at who raises the most gives a clear picture of the trends that investors are betting on right now. It may, however, only reveal short term trends (as more long-term and riskier ones shall attract only smaller amounts of capital).

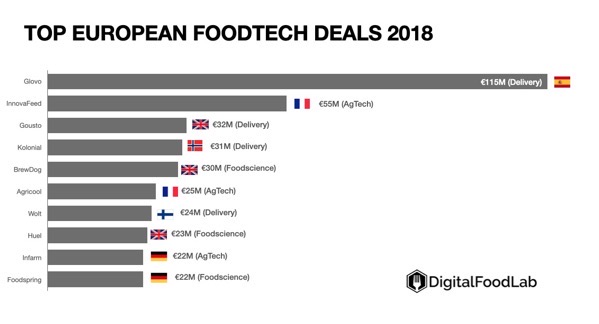

2018 vs 2019: DELIVERY STILL LEADING

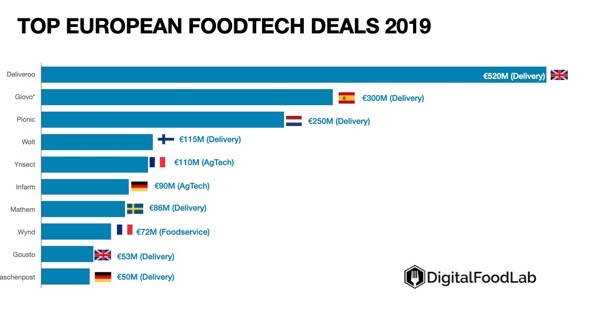

Comparing 2018 and 2019 top fundings is telling, with amounts growing significantly. Only two of 2018’s top ten would have made it into 2019’s list. But outside the amounts raised, looking at both graphs shows:

- 11 (4 in 2018, 7 in 2019) of 20 deals were made in delivery. However, let’s not jump to easy conclusions. Most of those deals are by players operating outside the traditional restaurant delivery business. Indeed, most of them are looking into ways to deliver your groceries, either through meal kits (Gousto) or by reinventing the online supermarket (Mathem, Kolonial and Picnic).

- 5 are AgTech deals in two sub-categories: urban farming (Infarm vs Agricool) and AgBiotech (InnovaFeed vs Ynsect competing on the same model of using insects for animal feed)

- Only 3, and all in 2018 deals on foodscience, none of them on plant-based or protein alternative related subjects. This underlines once more the almost absence of the European FoodTech ecosystem here.

2018 top deals

2019 top deals

Find out more in our FREE REPORT ON European FOODTECH INVESTMENTS