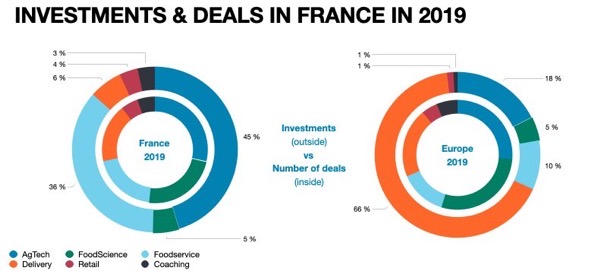

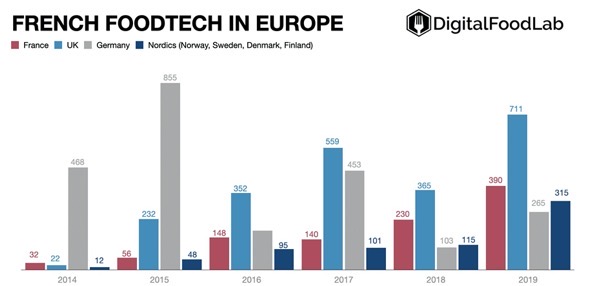

French FoodTech is only second to the UK’s ecosystem. Indeed, it leads to the number of deals bigger than €1M but still lags behind in total investments (notably due to the lack of unicorns). While the distribution of the deals (inside wheels) is similar, when we look at investments (actual euros invested in the outside wheels), the difference is significant.

Contrary to most countries, investments in French FoodTech are not led by delivery startups. The frenzy of investments in restaurant delivery startups has never reached France. And now, it seems to stay away from the next wave of huge deals to develop e-grocery marketplaces (such as Picnic in The Netherlands or Mathem and Matsmart in Sweden), even if a couple of startups have started to grow a significant size locally (La Belle Vie, La Fourche).

France’s FooodTech is clearly led by AgTech and Foodservice. And like other European ecosystems, if the number off deals in Foodscience has been increasing in the last couple of years, this does not yet translate in the amounts invested in this category (which is even declining).

France leads for the number of deals bigger than €1M but still lags behind in total investments (notably due to the lack of unicorns).