2021 is an extraordinary year for the FoodTech ecosystem. You may have followed the impressive number of megadeals (deals bigger than $50M) made since the start of this year, notably in quick commerce and alternative protein startups. Beyond investments, there is a “general feeling” that things are accelerating. But how much of this feeling is backed by data, and how is much is wishful thinking?

We decided to make a quick update to our yearly report on the Investments in European FoodTech in the first half of 2021 to see how good our intuition was that something was happening. Indeed, as for other tech ecosystems, we don’t have a lot of ways to measure what is happening others than the investments made in the ecosystem (the number of active startups is hard to follow, acquisitions can be high or low independently of the overall ecosystem’s health and the number of articles in the media is only good to measure the appetite for some specific B2C themes).

Something is indeed happening :

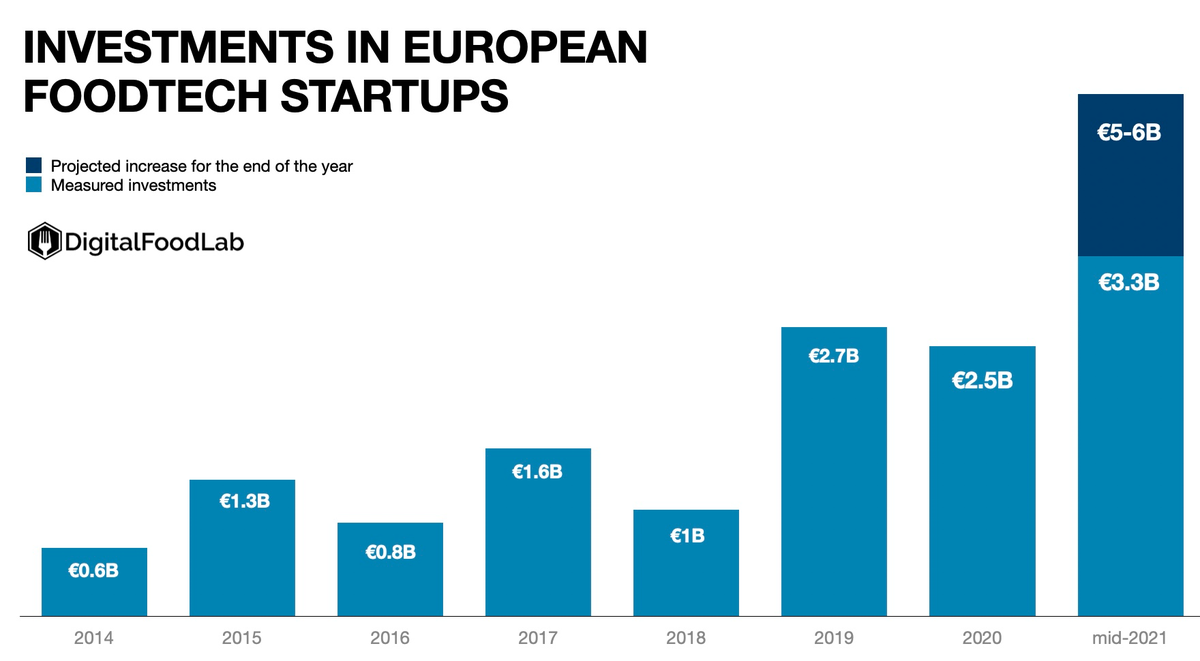

- investments are already higher for the first half of 2021 than for the whole of 2020 or 2019

- €3.3B have been invested from January to June 2021, and we can expect between 2 to 3 additional billion to be invested by the end of the year

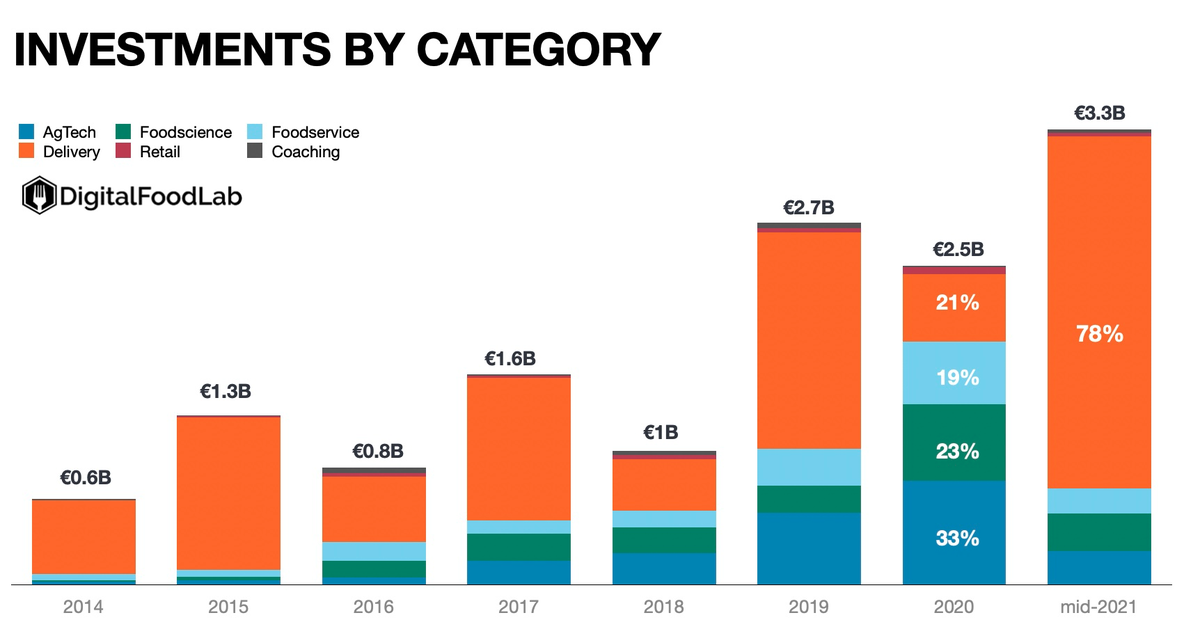

- 78% of the money invested in the first half of 2021 went to delivery startups, notably quick-commerce companies (and we don’t take into account the investments in Turkish startup Getir)

- While the amount of money invested in food science (notably alternative proteins) is on par with 2020, the other categories are in slight decline

- Geographically, the Nordics (with Wolt, Kolonial, Mathem, Matsmart) are leading with €950M in investments in the four countries

- They are followed by the DACH (Germany, Austria, Switzerland) region, Spain (Glovo), the UK, the Czech republic (Rohlik), Italy (Everli), the Benelux region and France (which is not the first country in Europe for FoodTech as France’s minister for agriculture boasted in an article, but rather the 11th due to an absence of delivery megadeals)

- Last, this trend is not specific to Europe. It is on par with what is happening at a global level. AgFunder reported that the level of global investments in FoodTech in the first half of 2021 is close to what it was for the whole of 2020.

So what does it mean? Is the future of food on its way?

I would like to say that it is a start in an exponential increase in interest and investment in the future of food, but that seems a bit far fetched. However, a doubling in the amounts invested in the space is not something that can be overlooked. It has not yet percolated to other categories outside of grocery deliveries in Europe, but it seems to be the case in the other geographies we have looked at.

Beyond the level of investments, it signals that investors are readier than ever to invest in the infrastructure of the future of food. Indeed, what are grocery delivery investments other than investments in warehouses and, more broadly, in new supply chain infrastructure? That signal is significant. Indeed, the investments that will have to be made to transform our food system will more and more be looking like infrastructure rather than deep technology:

- urban, indoor, and more generally novel farms technologies are now almost mature and deploying them will require huge amounts of money

- alternative proteins already require huge investments today for new production lines and tomorrow for bioreactors (some reports talk about $30B just to be invested into them to reach a small share of the animal proteins by 2030)

Many feared that the money to sustain these investments into scaling rather than tech itself would be hard to find. This increase in investments may be proof that it is quite the opposite. Hence, the future of food may be coming much sooner than expected.