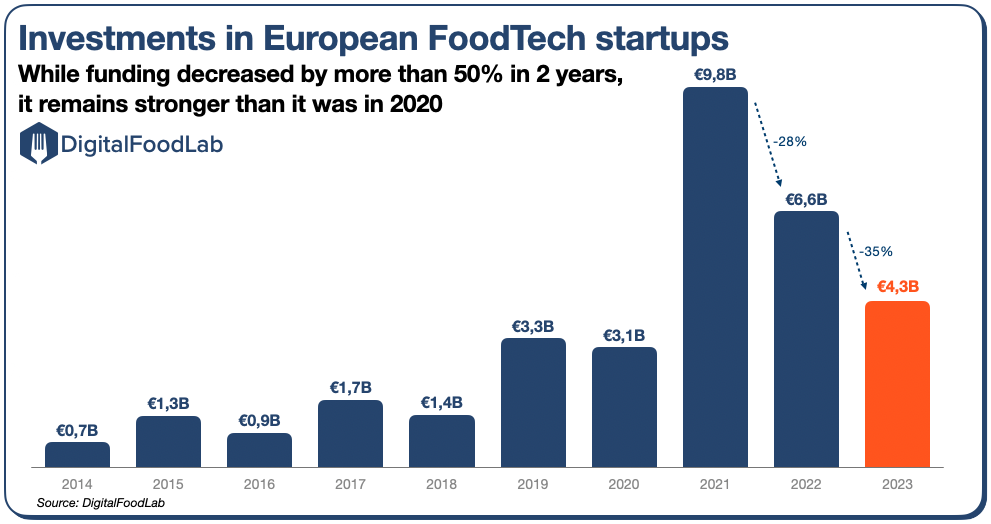

Investments in European FoodTech startups are declining, but there are many reasons for hope

European FoodTech startups raised €4.3B in 2023, a 35% decrease from 2022, and 56% from 2021 when investments reached their peak.

If investments are declining in Europe, they are much less affected than in other regions. Global investments decreased by almost 56% between 2022 and 2023. As a consequence, Europe’s FoodTech weight increased. Now, Europe accounts for 32% of worldwide FoodTech investments, up from only 14% in 2020.

While there is less money, we observed an increase in the number of deals, notably in early-stage. Investors are still very active in Europe and are betting on startups with an edge to surf long-term trends. In turn, the decrease in funding is due to a drastic reduction in large deals.

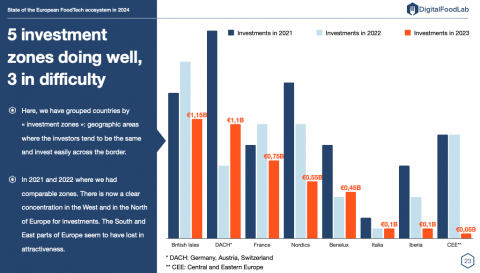

With some exceptions, European ecosystems have been affected similarly. The UK, France, and Germany remain the three leaders. The most badly affected ecosystems are those depending on a single (often delivery-oriented) startup.

Investments in upstream and midstream startups increased

Delivery investments are declining (more than 90% since 2021). Excluding delivery, FoodTech investments in Europe were not far from being stable.

Investments in AgTech (bioinputs and farm management) and in Food Science (alternative proteins and new brands) even increased.

The European FoodTech ecosystem is proving resilient in such a difficult context. While its startups and investors have many challenges to face, it is very well-positioned and is becoming more dynamic year after year.

In this report

This report studies investments in FoodTech startups in Europe from 2014 to 2024 and contents:

- an analysis of the number of investments and the total amount invested

- a breakdown country by country of major deals and funding rounds

- a comparison between the six major categories of FoodTech

- M&A and notable corporate involvement as investors in European FoodTech in 2023

This report was made possible with the sponsorship of Nestlé

Nestlé is the world’s largest food and beverage company, with more than 2000 brands. At Nestlé, we constantly explore and push the boundaries of what is possible with foods, beverages, and nutritional health solutions to enhance the quality of life and contribute to a healthier future. We focus our energy and resources where unlocking the power of food can make the greatest difference to the lives of people and pets, protect and enhance the environment, and generate significant value for our shareholders and stakeholders alike.

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

5 rue Paul Dupuy, 75016 Paris, France