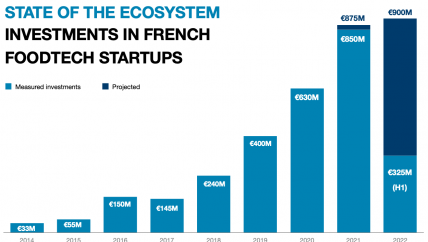

French FoodTech startups raised €875M in 2021, 40% more than in 2020

In 2021, French FoodTech startups raised €875M, 40% more than in 2020, which was already an extraordinary year. In the first half of 2022, despite strong headwinds and a global decrease in tech investments, investments are well-oriented.

On the bright side, we observe that year after year, the last « historic » challenges of the French FoodTech ecosystem are now solving themselves:

- Foreign investors are much more active in France than they were previously;

- The number of acquisitions is up compared to previous years. Some are notable such as Cajoo’s or Frichti’s. Many are done by other startups at lower-than- expected valuations. This is nonetheless highly positive for an ecosystem which was (and still is) full of zombie startups (that have raised some money, generate some revenue but don’t grow much);

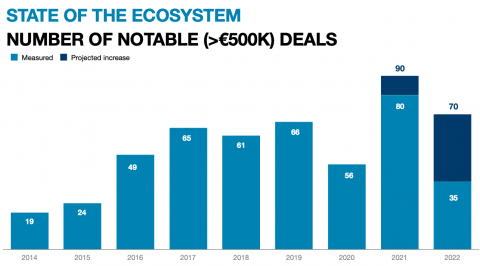

- Early-stage deals are finally growing in size and quantity. Entrepreneurs are now given the means to implement their visions early on. This also translates into a steep rise in the median series A deal, which was smaller than in other European countries.

However, the French FoodTech ecosystem still has many weaknesses, among which:

- its « rank » in Europe (and hence in the global FoodTech ecosystem): 3rd in Europe in 2021, only 4th for the first half of 2022.

- Its focus on B2B, with fintech startups working on restaurant payments which have a hard time differentiating themselves from competitors, and on insects-for-animal-feed startups. This focus also means a very small number of startups and deals made in the « hypest » parts of the Foodtech ecosystem, such as food delivery and alternative proteins. This is changing in 2022, notably with the help of foreign investors.

If we balance the positive and the negative, we see that 2021 was pivotal. Things are changing fast, with many high-potential new ventures getting (well) funded. We remain convinced that if one continent should lead the FoodTech revolution, it should be Europe. And in this continent, who could be better suited than France and Paris to be its beacon?

In this report

This report studies investments in French FoodTech startups from 2014 to 2022 (H1) and contents:

- data on investments and the total amount invested

- a comparison between the 6 major categories of FoodTech

- M&A in 2021 & H1 2022

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de L’Opéra, 75001 Paris, France