One of the key aspects of food that we tend to forget is how it gets to us. I often think that most consumers prefer to ignore the many steps required between farming and distribution. Indeed, while it’s common for people to feel passionate about agriculture and cooking (and many switched jobs after COVID to become farmers or bakers), it’s pretty rare to meet someone with strong and positive feelings about the food supply chain.

Nonetheless, it’s a fascinating topic where innovation is much needed. Just consider this figure: 40% of all food is never eaten and never leaves the farm or the factory (15% never leave the farm in the UK, and 16% in the US).

The current inflation situation and the refocus of FoodTech investors on B2B projects with shorter paths to profitability have a rather positive impact on this ecosystem.

We now consider this one of the six key FoodTech megatrends (alongside “the resilient farm”, sustainable proteins, personalisation, food automation, and instant retail).

Two underlying forces are driving this megatrend:

- The fight against waste (from packaging and food waste): this is directly related to climate change and the growing concern of consumers and companies about their impact. Interestingly, while consumers don’t prioritise a less carbon-intensive diet, they feel strongly about food waste, plastic pollution and recycling.

- Digitisation to reduce labour costs and promote standardisation: the accessibility of new digital tools throughout the food supply chain is changing how people work and collaborate. We analyse the recent development as linked to the decreased availability of unskilled workers (notably in foodservice) and the desire for more standardisation from CPG companies and restaurant chains. Indeed, with the use of B2B marketplaces and digital tools, consumers can have a much more similar experience from one store (or restaurant) to another.

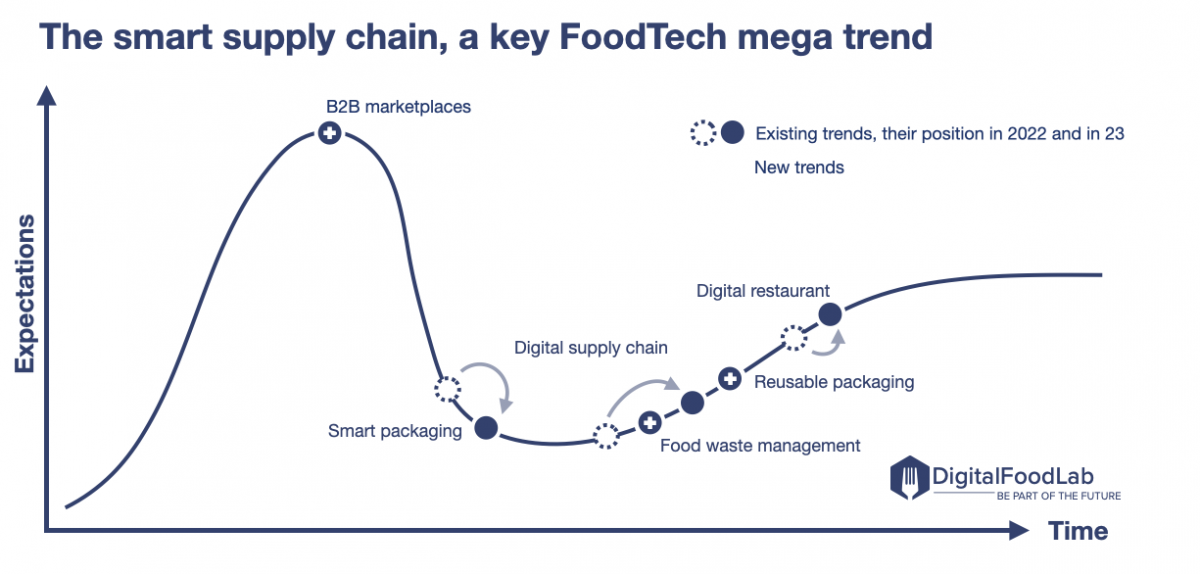

We have identified on the hype curve above six FoodTech ecosystems which are promoting a smarter supply chain:

💻 The Digital Restaurant: here, we are talking about the ecosystem made of startups working on digitising the operations of the restaurants from payment to HR management. If we exclude the bubble around pay-at-table (quite a fascinating topic: in a year, it appeared, everyone was talking about it, startups raised huge amounts of money… and now it’s over), this is a very active group of startups, notably in terms of acquisition. As shown on the curve above, it is quite advanced, so it’s not here that we expect the most disruptive innovations.

📦 Packaging, which we split into two categories:

- Smart Packaging: startups trying to find alternatives to plastic for food packaging or reduce food waste through the pack (using sensors or edible biocoatings such as Apeel’s). We are getting excited by this space because we are finally observing entrepreneurs targeting the challenge of fresh food products (which are then “not dry” and require a combination of barriers from the open air not to rot or lose their organoleptic properties).

- Reusable Packaging: we added this as a separate trend as the startups here are less innovating on the pack itself than on the business model. This is yet a very European ecosystem (due to regulations forbidding single-use packaging in restaurants). In the next couple of years, we’ll see if these startups can become major players as they face upfront investments in the required infrastructure to clean and distribute their containers. On a side note, it should be mentioned that while we believe in the model for B2B applications (to deliver food products to restaurants, for example), we have doubts about the real impact for B2C applications (for delivery notably, where consumers tend to “forget” to bring the used container).

🗑️ Food waste management: solutions are being developed all along the food supply chain, from the farm to the restaurant and the grocery store, to limit the quantity of food waste to a minimum. It involves various solutions, from monitoring food waste in restaurants (e.g. Winnow) to tools to manage unsold food products (such as marketplaces or in-store dynamic pricing)

💳 B2B marketplaces: this is one of FoodTech’s 2023 hot spots. While investments are decreasing in most categories, they are still rising for B2B marketplaces. These marketplaces are operating a wide range of business models (from purely digital marketplaces to players launching their distribution) around a straightforward idea: better connecting suppliers (CPG companies and other food vendors) to small retailers (mostly restaurants in developed economies but also corner stores in other parts of the world). Here, the benefits are obvious for these restaurant and storeowners: they will save a lot of time and potentially lower their costs. At the same time, we can expect a reduction in food losses if orders are better managed. This space is not only driven by startups such as Choco; some companies, such as ABInbev and its Bees platform, are also leveraging their existing network of buyers to create new businesses.

As you can see, it is possible to get excited by the food supply chain and, notably, the potential of new technology to make it smarter, more efficient, and more sustainable. While this is a topic we are discussing with our foodservice clients, we think that other companies should consider how to take advantage of these innovations and disruptive trends. As mentioned, some food giants are trying to reinvent themselves as technology companies while other smaller companies are finding new ways to reach their clients or optimise their supply chains.