Again, we are at this time to summarize and assess the year. However, this time, I’ll leave it at next year (even if I am quite pleased when I look at the predictions DigitalFoodLab made in January). Indeed, we invite you to a webinar on the 10th of January (10am CET) to reflect on 2022 and, most importantly, to look at the trends to watch in 2023.

In family gatherings during the holiday season, I am often met with sceptical eyes when I say that my daily job is to advise large companies on how to plan and act now to be ready for the future of food (and that they, amazingly, pay for it). If you are like me, I gathered a few fun facts about FoodTech, which could be used as conversation starters or as ways to look smart. For the others, these will be, I hope, insightful, if not fun.

1 – The most subscribed Youtuber, Mr Beast, launched its own chain of restaurants this year and is now planning to raise $150M at a $1.5B valuation.

If you have some time to spare, have a look at the videos of MrBeast (like this one around eating 24k-carat coated foods). Using its huge fanbase, he launched his own burger chain, first virtually and now with physical joints in the US. These are incredibly successful. Now, it is even planning to raise $150M.

This shows the huge potential of celebrity brands in food. If you want to dive deeper, here is the (as always) fascinating New Consumer report with many insights on the subject. We notably learn that, not surprisingly, it works best for younger generations and higher incomes, and the best food products would be restaurants, packaged foods, beverages and supplements.

The big question you can ask yourself and your loved ones is: which celebrities could make you buy food they would brand with their names?

2 – Plant-based foods don’t taste good, and consumers are not ready to buy them

Here is something you can certainly agree with the meat-lover members of your family while explaining the consequences of animal products on the environment.

A few weeks ago, we organised a blind test of 20+ plant-based alternative products and compared them with the “real stuff”. We had 5 “chicken” 🍗 products, 5 🥩 “burgers”, 4 🌭”sausages”, and 3 🥓 “lardons”. I often try alternatives, but not in a way that enables comparison.

On all the products we experienced (excluding sausages), the “real” meat product was without any doubt distinguishable both in taste and visually. Many products were clearly tasting awfully bad (or, to be more objective, they had a very different taste than the meaty product).

However, all is not bad. First, some products were approaching meat products in nutrition, taste and appearance. It was notably the case with Planted and Heura products. Secondly, as this market is driven by the offer and not (yet) consumer demand, having more products on the shelves is always beneficial.

3 – Plant-based foods should be cheap

A recent study conducted by MyVegan (the vegan brand of MyProtein) found that 19% of British people were eating more plant-based foods to… reduce their bills. Indeed, even above taste, the first element that drives the acquisition of a food product is price. Current sales data show that to sell a plant-based alternative instead of a meaty product, its price should be less than 90% of the “real stuff” price.

People don’t tend to be honest when you ask them the reasons behind their acquisition of a food product. Still, it is always fun to make a quick family survey and to compare it to actual data (a simple proof could be the amazing growth of discount grocery stores).

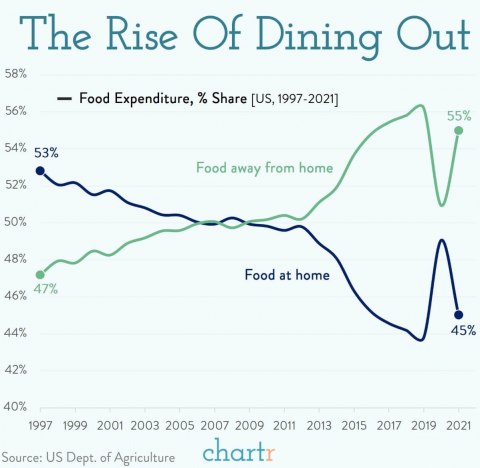

4 – People spend more on their food out of home

This is a decades-old trend which has not been reversed by covid. While many startups are raising billions to deliver groceries, the future may be in restaurants. Consumers (at least in the US, according to this graph) spend more and more of their dollars on out-of-home meals and less at home.

Today, even if food inflation is high (and higher on groceries than on restaurant meals), it should not have a huge impact.

This tends to confirm a trend where we put less value on the food products themselves and more on the experience associated with them. That’s something that should make food brands think a bit more about their future.