Instacart, the US-based grocery delivery unicorn, is planning for its initial public offering (IPO) in the coming weeks. We can learn many things from this announcement and the documents released by the startup.

First, what is Instacart?

While ubiquitous in the US, the startup is unknown in the rest of the world. Instacart is basically an Uber for groceries: consumers shop on Instacart’s website or app, and an independent “shopper” will pick up the groceries for you in the store you selected (among a list of 1,400 partners). 7.7M users use it each month and have spent $1.5B on the platform in the first half of this year. In a word, it has become a dominant player in the US online grocery delivery market.

An IPO was rumoured to happen after COVID. However, it was postponed, and like many other startups, Instacart saw its valuation decrease severely from $39B to $10B.

Why does this IPO matter?

Simply put, after a series of deceptive IPOs of food delivery startups (and more generally of food startups), there are great expectations that this one could turn the tide. Indeed, after insane growth during lockdowns, it has become profitable, a rare feat in the food delivery category.

On the other hand, most, if not all, food delivery companies (DoorDash, Delivery Hero…) are investing massively in their grocery delivery businesses. There is, then, hope that they could, too, become profitable.

An e-commerce service provider rather than a grocery delivery business?

At least, that’s how Instacart would like potential investors to see its business. It insists on being a partner to grocers. Beyond online customers, it provides them with a wide array of technology (such as smart carts for their physical stores).

Interestingly, that’s also how many other food delivery platforms are trying to rebrand themselves. They are notably developing (or acquiring) new services for restaurant owners.

A focus on advertising

While the company’s growth stalled in the past year (only 4% growth), its revenue increased, mostly due to advertising. Thousands of brands are using Instacart’s ads to target consumers. While there are doubts about the potential viability of such a reliance on advertising and technology services, it is somewhat close to Amazon’s business model. F&B giant Pepsico believes in it, as it just announced a $175M investment in Instacart.

And again, this is a trend we observe across the food delivery category. Uber announced last year that brands and restaurants could now target its riders through its app.

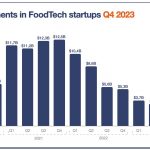

In conclusion, that’s a pretty significant IPO, even for a startup that many of you have never heard of. Instacart is one of the global innovation leaders in food delivery. First, I think it is one of the companies to have on your radar to see how things are going and the trends (alongside other unicorns). Second, the market reaction to this specific IPO could be a turning point for the general mood around FoodTech investments. Indeed, Food delivery still accounts for most of the money invested in FoodTech, and a more positive mood around the potential of this category could create the bounceback that we are hoping for.