Last week, our friends at Agroecology Capital (a US-based VC firm investing in bioengineering and data/software solutions for agriculture operations) released a report on the investments and insights in Vertical Farmings. As this area is clearly one of the most exciting in FoodTech, we decided to share with you some of their conclusions.

Is there a case for Indoor vertical farming?

As recently explained in a detailed article (and a podcast episode available here) by The Economist, vertical farming may have a bright future. It will not replace all of the agriculture but could a good complementary solution and an answer to many issues such as:

- The diminution of agricultural land driven notably by spreading cities

- The increase in demand for food products as the population continues to rise in developing countries

- The need for better and more traceable foods. No matter how odd and contradictory it seems but indoor agriculture farming may be a solution to the lack of trust for consumers looking for local foods

- The ecological impact of food both when produced and transported

Investments

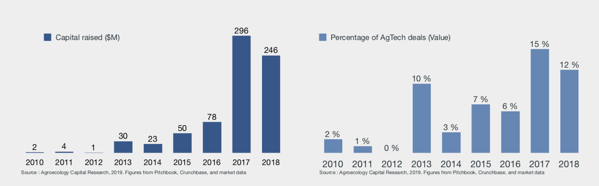

According to Agroecology Capital’s report, $873m have been invested in indoor vertical farming startups since 2010. While investments have risen, notably in the last couple of years, as you can seen on the graph below, they are still small in comparison to AgTech/FoodTech in general (just to give a comparison, last year’s investment in FoodTech globally were around $13B).

If investments in FoodTech are still globally dominated by the US, their share is now decreasing (around 55% in 2018). However, the report shows that Vertical Farming investments have been highly concentrated in the US with 89% made there.

Next steps

If the ecosystem has already big names such as Infarm or AeroFarms, the “right” technology and business model (which can be translated by “profitable”) have yet to be developed. As underlined by the report’s conclusion, right now, most of urban farming startups are fully integrated from technology to production and even branding/retail in some case. This is often the case of early-stage foodtech ecosystems where startups are fully integrated and differentiated on their technologies rather. It often leads to specialisation for those first movers and to a second wave of more focused startups. So, even if urban farming startups may not be profitable in the next couple of years, it is still a fascinating and promising sector to explore.

You can download for free the report here.