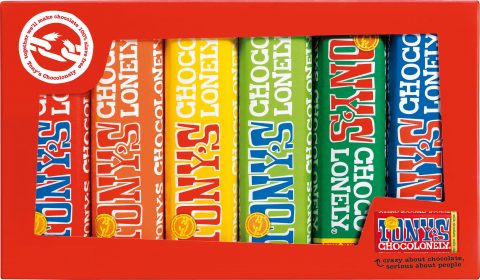

🇳🇱🍫 Tony’s Chocolonely, a Dutch chocolate maker, raised €20M for its mission to make chocolate 100% slave-free. With this deal, the family office behind ABInbev will be a majority stakeholder in the company.

This is definitely our food product coming from a startup-with-a-mission. It succeeds in 3 different areas:

- It has a clearly stated mission: removing slavery in cocoa farming. Beyond that, the brand also educates consumers.

- It is a good and remarkable brand

- It is a delicious product. While being the most important point (consumers buy and repurchase tasty products, and not missions), startup food brands too often forget this.

🇺🇸 🥯 BetterBrand, an American startup, raised $6M for its better-for-you bagels at a $170M valuation! Actually, BetterBrand is much more than a bagel startup. It has developed a technology that enables the creation of healthier alternatives to baked goods which contain much more protein and fewer carbs (90% less in the “Better Bagel”). We observe a growing appetite in the “better for you” ingredient ecosystem, notably around technologies that reduce carbs, sugar and fat.

🇫🇷 🥣 Resan, a French company, raised €3.1M, notably from Danone, to help dairy farmers to produce their own yoghurts. Farms are equipped with what the startup calls a mini-factory, and then the yoghurts are under an umbrella brand “J’achète Fermier” (I buy from the farm). It is a way to increase the revenue

🇺🇸 🥩 Eat Just and Upside Foods, two US startups, just received the final approval to sell their alternatives to chicken created through cellular agriculture in their home country. As said in our last newsletter, this is a very significant step towards the “future of food”. With this first approval in a major market, we’ll finally know what the consumers’ reactions will be and then we’ll be able to see what is the future for this technology in the protein market.

🇧🇷 📈 A new report from AgFunder on FoodTech investments in Latin America shows that it is definitely a place to put on the map if you are interested in AgTech. The ecosystem seems quite concentrated in Brazil, which accounts for almost 50% of the deals and the money invested on the continent.

🇫🇷 💳 Obypay, a French startup, raised €1.2M for its platform to digitise restaurants, notably through its pay-at-table solution.

🇺🇸 🔬 Hyfé, a US-based startup, raised $9M for its technology that converts wastewater into valuable feedstocks for microbial fermentation.

🇫🇷 🍃 Agripolis, a French urban farming startup, is being put in receivership. This is another blow to this ecosystem.

🇬🇧 🦾 Karakuri, one of the most highly regarded and most well-funded food robot startups, is shutting down. Now, it’s like most of the first-generation food robot startups have been wiped out. New players, which rely much less on robotics, remain.