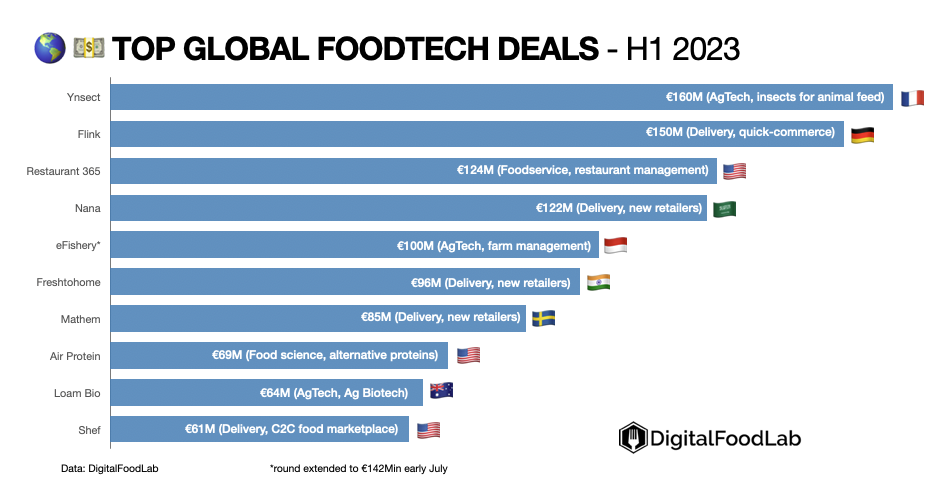

As we move into summer and the second part of the year, let’s look at the state of foodtech deals. For that, we have compiled the top 10 global deals at a global and European level.

From this top 10, we can learn two things:

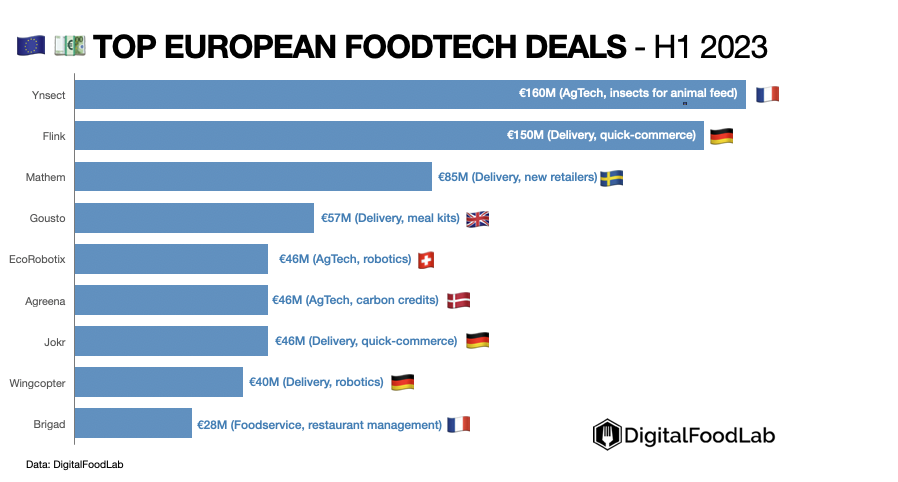

- No huge deals: compared to previous years, there are still “mega deals” or deals bigger than €50M… but what strikes me is the absence of what we could call “huge deals”. These investments of €200M and more were quite commonplace until last year. When we compile investments at the end of the year, their presence or absence makes the difference between a good and a bad year.

- The rise of FoodTech in Asia: while we observe a decline everywhere, we have noticed an increase in large deals in Asia, notably in Indonesia, India and the Middle East. These ecosystems have their own drivers and trends. With all this money going to some of their startups, they should be considered seriously.

If we look specifically at the dynamic in Europe, we can add:

- A confirmation that grocery delivery still leads FoodTech: no matter what we hear about it, grocery delivery startups are still raising the most with 4 of the top 10 global deals and half of Europe’s top 10.

- A touch of concern: when I look at this top 10, I see at least four startups that are rumoured to be in bad shape. While they may have raised very noticeable deals, they are either closing their operations in some countries (Flink, Jokr), slashing their valuations (Gousto), changing their management (Ynsect) or a combination of all the above.

And now, what’s next?

Even in this deteriorated context, massive investments are made in FoodTech startups all over the world. I remain strongly optimistic as all the recent growth of the FoodTech ecosystem was mostly led by investments into startups working on long-term and massive trends such as automation, alternative proteins, sustainable farming and online groceries.

We are observing the first hints that we have reached the bottom of the investment downturn. If deals are to increase in size and in number in a few months, now is the best time for established food companies (and startups) to start planning for their future.