Here, we often talk about startups, from early-stage ventures, which are barely more than ideas to unicorns (see our recently published report on the state of FoodTech unicorns here). However, we now have a growing number of “former” startups that have moved into the real world of publicly listed companies. As most have just released their 2023 results, it seemed a good point to look at how they are doing and also to introduce a new tool: DigitalFoodLab’s index.

1 – The great sorting: the 2010s food business models are bearing fruits (or going bust)

A few years ago, FoodTech was almost synonymous with food delivery. And there were, broadly speaking, two types of business models (at least, that’s where you found the unicorns):

- Food delivery platforms, notably Uber Eats, Delivery Hero, Deliveroo and DoorDash. These delivered restaurant meals and expanded into grocery deliveries through partnerships with retailers.

- Meal kits: services such as HelloFresh deliver recipe ideas and all the ingredients to execute them.

A decade later, food delivery appears as a winning model, while meal kits are a losing group. This is quite interesting as it is not what we could have assumed only a few years ago when most articles predicted the end of delivery.

🇺🇸 🛵 Uber posted its first annual profit ever. After years of negative results (and hence tens of billions of venture capital and debt), the ride-sharing and food delivery business model is finally proving to be viable. It is quite notable that it was the food business that saved the company during the pandemic and has become its most profitable part. Also, in the current inflationary context where consumers focus on the “essentials”, Uber’s food delivery is still in high demand, showing that it has become a vital part of their daily lives.

Also:

- Deliveroo upgraded its expectations for 2024.

- Just Eat Takeaway expects a 40% increase in profits in 2024.

🇩🇪 📦 Marley Spoon, a Germany-born meal kit startup and once a leading player, sold its US assets for $24M. The startup is publicly listed in Australia (its main market), and it has lost more than 99% of its value since its peak in 2020. It is impressive how a market once seen as promising is now considered almost worthless. Using the company’s market share in the US in 2022 (3%) and this $24M value, the whole US meal kit market would be worth less than $800M (which was coincidently Marley Spoon’s valuation at its peak).

Also:

- Blue Apron, once a leader, was sold for only $103M last year.

- HelloFresh decreased by 42% after it announced its 2024 outlook, which an analyst qualified as “far worse” than anticipated.

2 – It’s getting better for plant-based companies

Beyond Meat and Oatly, the two most well-known publicly traded plant-based companies, often act as an indicator of the whole market. Indeed, while others (private companies) keep their data for themselves, these two have to release sales indicators each quarter.

🍔 Beyond Meat announced that its revenues declined by 18% in 2023 compared to the previous year. It also lost almost as much as it earned in sales during the year. However, plans to decrease spending have made investors happy, and the stock bumped after the results were announced.

🥛 Oatly’s results look even worse: the company increased its sales but posted a widening loss of around $300M for the last quarter. This is notably due to costs related to discontinuing the construction of a new facility (another bad sign).

The only positive sign is that, in both cases, volumes are up. It shows that there is a current price war between players to achieve growth. It also seems from both cases that the worst is behind us and that the companies that survive in this space are now solid and agile enough to surf the (hopefully coming) next wave.

3 – How are the publicly traded FoodTech companies doing?

As I said, it can be hard to track the overall progress of these newly publicly traded companies and, notably, to compare them to the rest of the market. That’s why we have created an index with all the values of public FoodTech companies. You can access it here to check it and also look at the list of 22 values we have identified (if you think about others we should add, let us know). We have kept things simple: today, the index is rebalanced quarterly, and all companies are equally weighted.

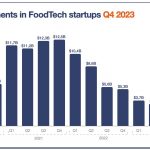

Both graphs compare the index’s (purple) evolution to the overall market’s (orange) and Nasdaq’s (blue).

As you can see in the first one above, when we take the long view (relatively speaking), FoodTech startups have really underperformed.

Even if we zoom on the months since the start of the year and the somewhat positively received results we mentioned above, this index is still down by more than 4% and has a 15% gap with the tech-oriented Nasdaq (in which many of them are nonetheless listed).

We will update this index with companies going through IPOs or newly accessible companies. This is one of our tools for following the trends shaping the future of food. It notably helps us when setting up bespoke watch newsletters for clients or when we want to put some startup information in perspective when diving into a topic. Let us know if you have any questions about it!