Today, I’d like to focus on four graphs that can help us better understand the contradiction in the trends shaping the future of food.

1 – Four worldviews for the future of food

I often wonder why it is so complicated to talk rationally about the solutions for the future of food. Beyond the passion created by traditions and culture, there is also a clash between the different solutions, depending on your worldview.

A recent report published by Green Alliance proposes a framework of four worldviews. Each of us is supposed to be a mix of two or more of them.

I found this approach quite interesting in understanding the positioning of different players, notably in the current context of farmer protests in Europe and the tense debate about the role of alternative proteins.

Beyond this, the report underlines that no worldview can overrule the others and that only a coalition of two would create a majority. In my view, there are two paths:

- the optimistic view: an alliance that could deliver good results for the planet between “technovegans” (people focused on using tech for downstream applications, notably alternative proteins) and agro-ecologists or sustainable intensifiers (focused on using tech for upstream applications).

- the realistic path: with poor climate outcomes: an alliance between agro-ecologists and traditionalists that we currently see growing in Europe notably.

You can download the full report here.

2 – 80% less funding for cellular agriculture

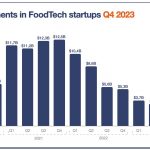

Last year’s funding for startups using cellular agriculture focused on meat and seafood alternatives decreased from $807M to $177M. That’s a 78% decrease, which should be compared to an “only” 50% decrease in the overall FoodTech ecosystem.

This is due to both fewer, smaller deals. Many startups have had downrounds, which combined a lowered valuation and smaller funding (usually, as a startup matures, it is supposed to raise bigger and bigger rounds to finance its growing operations).

This could appear surprising as companies have finally received regulatory approval in the US and can now start selling their products. However, they are now facing serious doubts about their ability to deliver results and produce meaningful quantities of products. Upside Foods, the most well-funded startup, embodies this perfectly. Article after article spread rumours about its ability to grow any significant amount of meat, and now it is laying off staff while shutting down its plans to build a large-scale factory.

While we remain convinced of the potential of cellular agriculture, the current bottleneck created by the inflated expectations set up by many startups and investors will have to be resolved. Then, if, and only if, some companies achieve scale-up production, hype and money will come back.

3 – Palm oil, often considered bad for the environment, is much less land-intensive than alternatives

In this article on why palm oil is not as bad as its reputation, a couple of charts illustrate this oil compared to vegetable alternatives.

While palm oil is (rightly) linked to deforestation, it actually requires much less land than other oils. This illustrates the complexities of classifying ingredients as “good” or “bad”.

4 – A thirst to fund water-focused startups

We recently released a note on water. It showed how much innovation was needed for water conservation. As you can see below, investors have also noticed how hot the topic of water has become. In the current context of decreased investments, achieving a “flat year” for water treatment and conservation investments is quite a feat.

We observe a growing interest in this category, from large-scale infrastructure to startups. Some even have original solutions, such as Epic Cleantec, which transforms wastewater into beer.