Unicorns have lost some of the cool factor and also a lot of their value in the past couple of years. However, they are still beacons of the overall FoodTech ecosystem. Instead of looking at tens of thousands of startups scattered all over the world, it can be easier to watch the tens of companies valued at $1B and more. That’s precisely what we do each year with our FoodTech unicorns report, and I am glad to share this year’s edition with you. As always, you can download it for free and access the mapping, graphs and the complete list of all FoodTech unicorns.

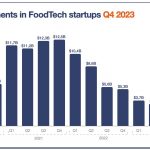

Let’s rewind a bit and talk about the current context of the innovation ecosystem: the global amount of funding for foodtech startups decreased by almost 60% between 2021 and 2023 (and the trend doesn’t indicate a bounce back). And then, we keep hearing about bankruptcies and layoffs. In a word, we were in a pretty pessimistic mood while preparing this report and the mapping below. But there is actually some good news.

There are now 59 FoodTech unicorns, down from 62 last year. Even so, considering the context, knowing that only five startups had their valuation decrease below the $1B threshold is almost surprising. Even better, three new unicorns (Zepto, Restaurant365, eFishery) appeared in 2023, and one (Inari) in the first quarter of 2024.

Quite counterintuitively, the most badly affected category wasn’t delivery but AgTech, where multiple vertical farming former unicorns are on the verge of bankruptcy. Beyond these startups, there are 5 to 10 startups still listed as unicorns where we have strong doubts about their prospects, notably if they had to raise money.

Finally, in terms of exit, there was no acquisition this year. However, there was a single but important IPO (Initial public offering): Instacart. The process went well, and a year later, the company is trading beyond its initial pricing. While we often focus on private funding (investments), it is also important to look at what former unicorns are doing. It is interesting to note that many of them, notably delivery companies, are now doing well on the public markets. This should help to reassure investors that FoodTech companies can deliver value.

I strongly encourage you to read the report and also to learn about these companies. They all have something for them, representing some of the finest solutions we have at our disposal to build the future of food.