Following last week’s release of our yearly report on the state of the European FoodTech ecosystem (download it here), I’d like to focus on another key point: the role of FoodTech in fighting climate change.

1 – what is Food+Climate Tech?

We define FoodTech as the ecosystem made up of all the entrepreneurs and startups innovating on products, distribution, or business models along the whole food value chain. This includes categories such as delivery startups, which have little to do with climate change. We can then refine this definition to create a sub-segment that we call Food+Climate Tech, which comprises:

- AgTech startups: all sub-categories are directly or indirectly related to fighting or mitigating (living with) climate change: farm management solutions, agbiotech, indoor farming…

- Alternative proteins and functional ingredients, notably those that use less natural resources.

- Supply Chain startups which are creating packaging innovations to replace single-use plastic packaging and those fighting food waste.

Download DigitalFoodLab’s European FoodTech report

And access a mine of insights on the top startups, emerging categories, and M&A trends shaping the future of food.

2 – How big is Food+Climate Tech in Europe?

Europe is often considered a leading region for investments in Climate Tech, so it seemed interesting to examine in detail the intersection of Food Tech and Climate Tech.

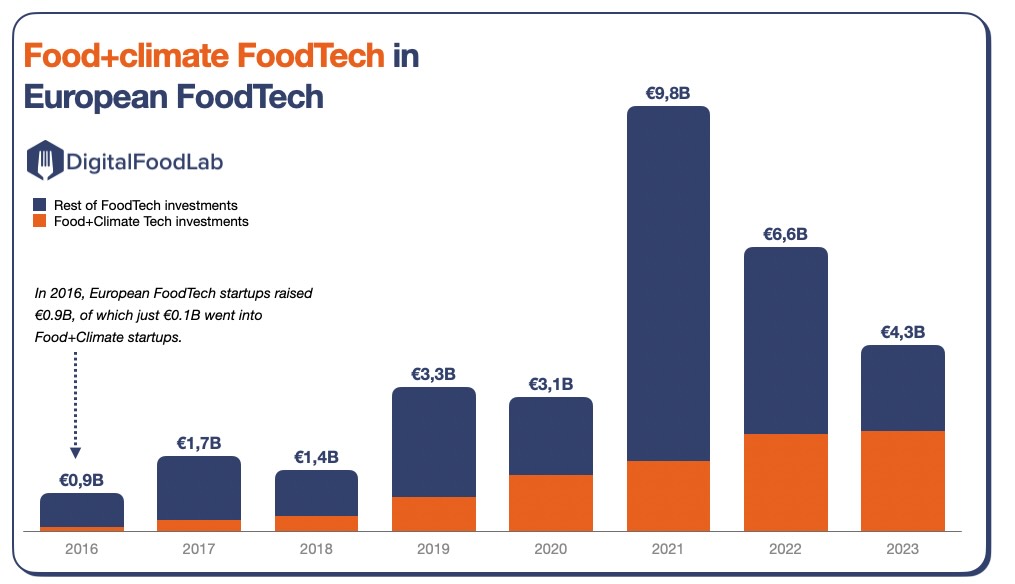

As you can see on the first graph above, investments have declined in the past couple of years, but… they actually increased in Food+Climate Tech. Climate-related funding now accounts for more than 50% of the total FoodTech funding, up from 10% 8 years ago.

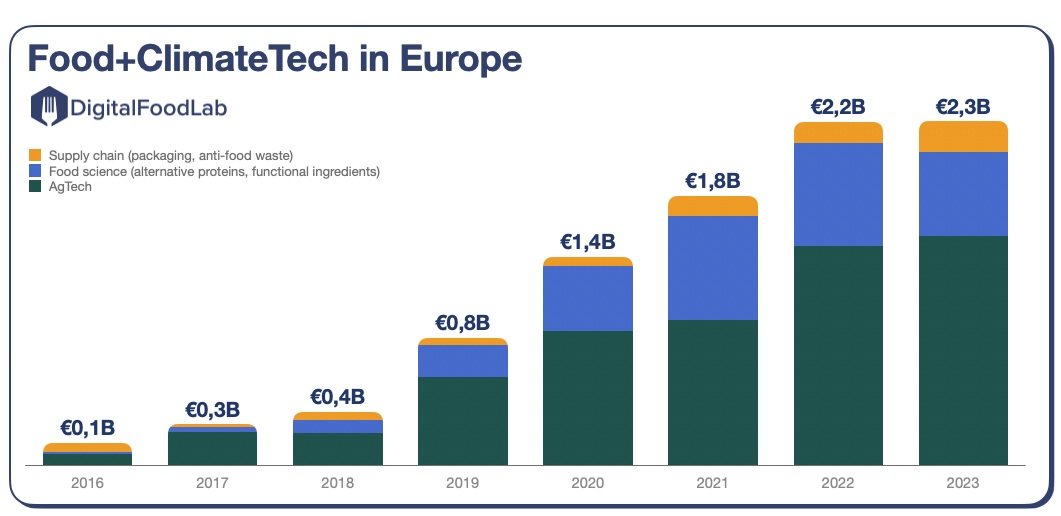

If we look in depth, this is mostly due to an increase in AgTech funding (which is itself linked to increased investments in bioinputs and in carbon credit). We also observed a surge in the amounts invested in packaging alternatives and anti-food waste software solutions.

3 – Is there “enough” Food+Climate Tech investments in Europe?

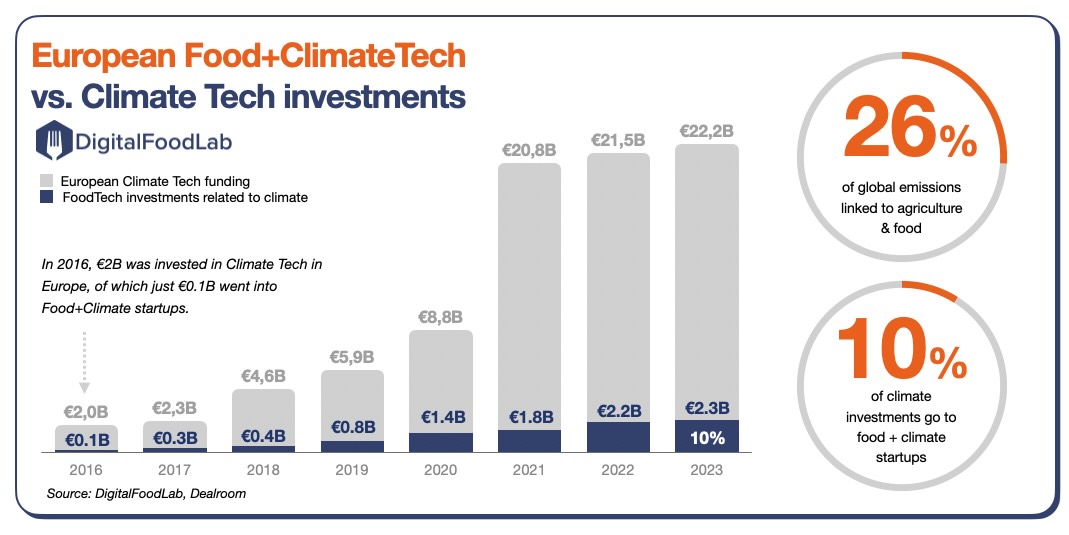

While it is complex to put a definite figure on how much investment should be put in Climate Tech, we can look at the share of these that go into FoodTech. That’s what we did we the above graph

As you can see, investments in Food+Climate Tech represent a tiny 10% share of all European Climate Tech investments.

This data point can be compared to the share of agrifood in global emissions which is at 26%. And indeed, much more funding is targeted at the energy transition or at transportation. To be justly represented in the amount of Climate Tech funding, Food+Climate Tech startups should received 2,5x more funding. This means a huge “gap” of €3.5B that “should” have been invested in Food+Climate startups.

4 – Which countries are leading in Europe?

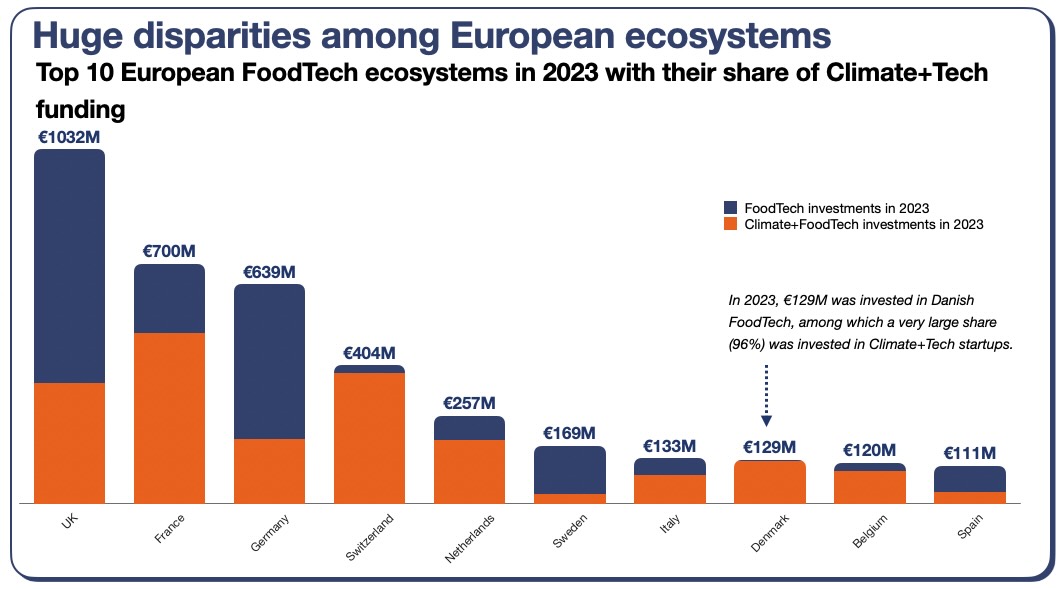

The above graph displays the top 10 countries for FoodTech investments in 2023. The ranking is quite different if we look only at Climate+Tech funding. The British, and German ecosystems appear much smaller then (due to a preference for brands and delivery startups).

In a word, the good news is that funding increased for Food+Climate Tech startups in a context where the overall investments declined quite drastically in 2023. However, this level of investments is insufficient. Due to the current context and also due to the multiple pledges large companies have made to reduce their emissions, we think that could fill the gap.

So now, what’s next? Investments in Food+Climate Tech will keep increasing, there is little doubt about that. Established food companies should lead there as they will need the solutions developed by these startups to achieve their climate pledges. This is one of the topics we are increasingly covering with our clients as they seek to engage with innovations reducing their impact. If this is also something you are concerned about, you should contact us.