I am glad to share with you a new report on the state of the Danish FoodTech ecosystem. We are releasing it with the support of Food & Bio Cluster, the national cluster organisation for the Danish food and bioresource industry.

First, you may wonder why focusing on Denmark. Indeed, if Denmark is not one of the biggest ecosystems in Europe but:

- again and again, while screening specific ecosystems, notably in the upstream part of the food value chain, we kept spotting leading Danish startups with a B2B and tech focus.

- If you have read our report(s) on the European FoodTech ecosystem (which you can download here), we may have noticed that we are quite excited by the broader Nordics ecosystem. We have already made a focus on Sweden, so Denmark was the obvious next step.

- Looking at different ecosystems is also a way to better understand how Creating and stimulating an ecosystem of startups and investors is a goal many countries share.

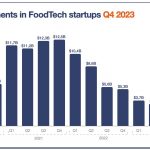

Sustained level of investments, even a context of general decrease in FoodTech deals

The key finding is that investments in Danish FoodTech startups are doing relatively well in the context of global and European decreases (see our latest updated data here). They raised €143M in 2022 and have already raised €80M in the first half of 2023.

It is easy to see where the money goes when we look at the top deals.

FoodTech in Denmark is concentrated in AgTech and Food Science. It is striking how it exactly matches the current trends in terms of investments: B2B, profitability and a focus on tech solutions to increase sustainability).

Two startups, ENORM and Agreena, account for 53% of the investments in 2022 and H1 2023.

These deals are notable. Indeed, it shows an ability to focus on certain categories rather than spread limited resources everywhere.

Then, the size of the deals is a testimonial of an international focus, a quality we often observe in Nordics’ FoodTech entrepreneurs (often lacking for French, German or British startups, which remain confined to their medium-sized market).

We link both qualities to two factors:

- The role of public players which focus on the bioeconomy and support startups with skills and funding: the BioInnovation Institute and the Export and Investment Fund of Denmark are the two leading investors in Danish FoodTech startups.

- Easy access for startups to the strong food-oriented activities at local universities.

Which startups should you look at?

Among the many Danish FoodTech startups, we have selected a “top 10”. It aims to provide both a snapshot of what’s happening in Denmark and an overview of the startups we think have the most potential.

The investments show that Danish FoodTech is mostly about AgTech and Food science. And even there, except ISH Spirits (a brand of alcohol-free drinks), it’s mostly B2B companies. We have selected:

- 4 AgTech startups: Agreena, a carbon credit and certification platform; AgroIntelli, a farm robotics startup; Enorm, an insect for animal feed; and Unibio, a biomass fermentation startup targetting animal feed.

- 4 Food science startups: ISH spirits; 21st Bio; Chromologics, which uses precision fermentation to produce colourants; and Kaffe Bueno, an upcycling startup focused on coffee grounds.

- Too Good To Go, well-known for its multiple models to reduce food waste.

- Quickorder, an ePOS solution for restaurants.

Beyond, we also established inside the report a list of another top 10, with younger startups with long-term potential.

Download the report here (for free)

In a word, the Danish FoodTech ecosystem is not huge, but it definitely deserves to be looked at. Investments are much more important when we compare the amount invested per capita (3 to 4 times more than most other European countries). Finally, most of the startups observed are focused on the current top FoodTech trends, which can only help this ecosystem grow further in the years to come.

Have a great week,

Matthieu