When we first set the definition of what FoodTech meat for us at DigitalFoodLab (back in 2016), we excluded petfood. It seemed a small, unexciting topic. However, since then, things have changed quite dramatically

🚀 Startups in this space multiplied and keep popping up everywhere

Below is a mapping of petfood startups. Doing it, we learnt that if startups started by creating marketplaces, now the biggest space is DTC (Direct-To-Consumer) brands. Contrary to other (food and non food) DTC categories, most of these brands are still not focused on retail but mostly centered on their e-shops.

It’s quite fascinating to see that these brands follow the trends of human foods with:

- personalisation: creating meals dedicated to the weight and specific needs of each dog.

- fresh food delivery: petfood is dominated by dry foods, but startups focus more and more on fresh (wet) food.

alternative proteins with vegan, cellular agriculture, precision fermentation and insects.

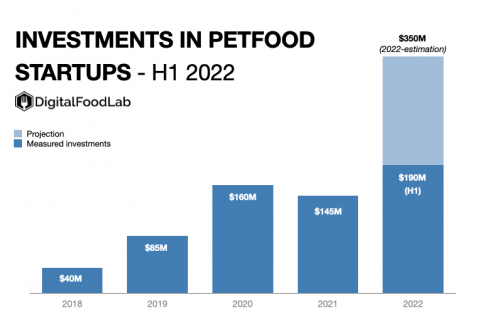

💰 Investors are following suit with much more money being poured into this ecosystem

Over the past 5 years, investors have increased their bets on petfood startups. Interestingly, as the overall food is not doing so well in 2022, investments are increasing both in number and amount.

Over the past 5 years, investors have increased their bets on petfood startups. Interestingly, as the overall food is not doing so well in 2022, investments are increasing both in number and amount.

🐶 Each of us adopted a dog, as many people did during COVID.

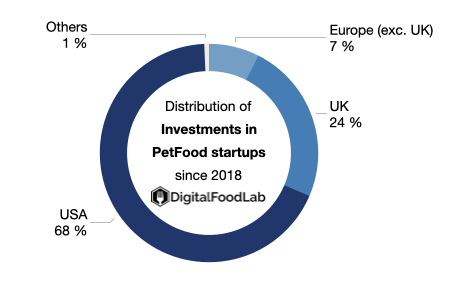

Why is there so much entrepreneurial energy and investments going into petfood? Simply because this market is huge (over $100B, with a significant share in the US) and growing at an impressive rate, notably after covid.

Many people adopted pets, and the new owners are looking to give them the best experience possible, notably by making them eat foods matching what they feel is best. Hence, the emerging trends of vegan or raw foods or CBD supplements.

🔮 Where is this space going?

This space is quite different from the “rest of the food”. It is dominated by two CPG giants (Nestlé and Mars), which have a strong relationship with veterinarians (when they don’t directly own the clinics) and breeders. This makes this market much harder to enter.

Beyond that, as most brands can’t access mass retailers due to their high prices or focus on fresh/customized foods, they are all competing online. Hence, following all the investments made into petfood startups, we can expect online acquisition costs to rise even more.

In a word, we expect to see some consolidation in the 18 to 24 months to come and then maybe a split between three categories: customised products sold uniquely online, supplements and treats, and alternative proteins. In this latter space, the lower level of regulation makes it possible for innovations (as is already the case on insects and maybe tomorrow on cellular agriculture and precision fermentation) to enter the market more easily than for humans.